Home Improvement Made Easy: Top 3 Financing Options for Remodels

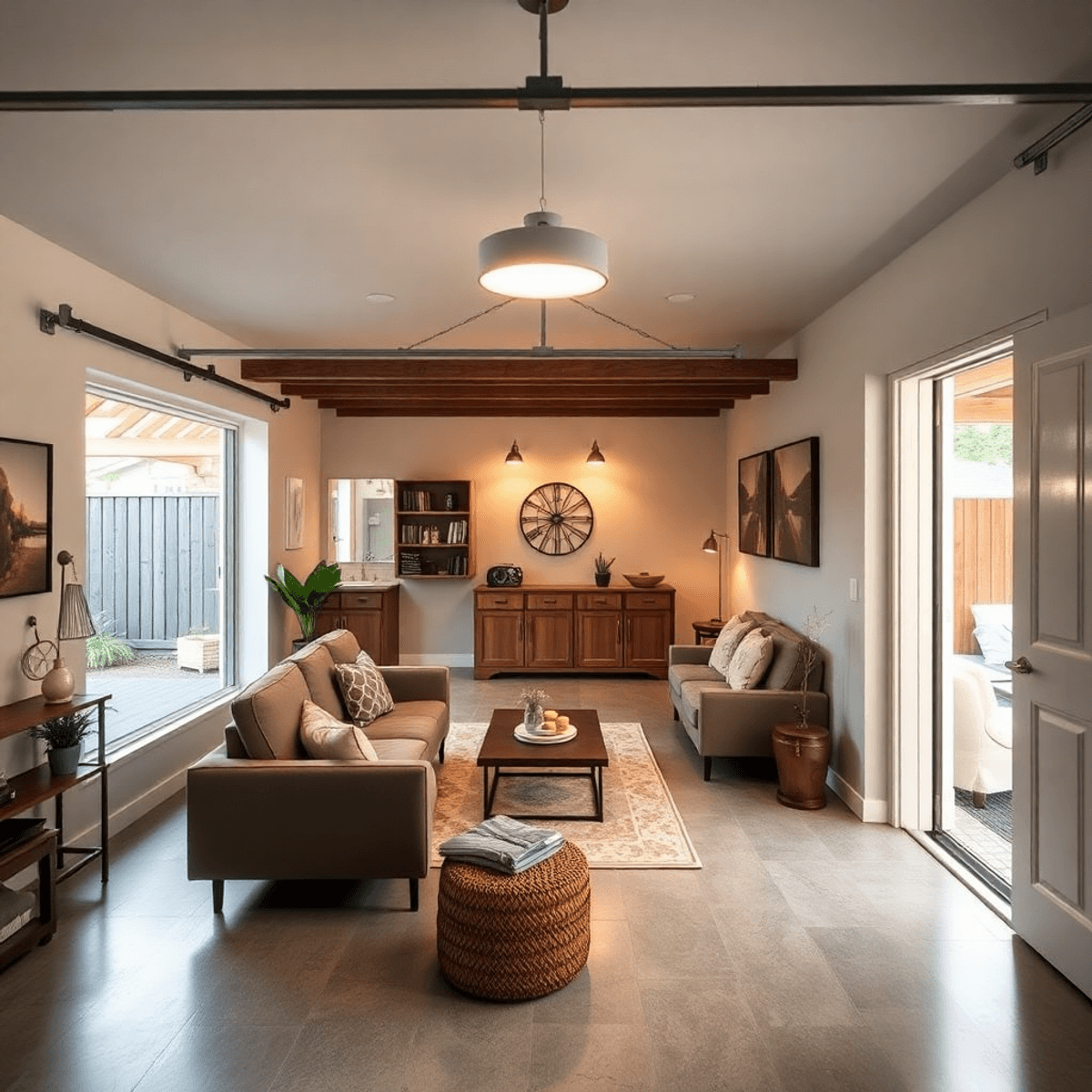

When starting a home remodel, having the right financing is just as important as choosing the right design or hiring a skilled general contractor. Renovations are a significant investment that can make your home more comfortable and increase its value. Knowing the best ways to finance your home remodel will help you start your project with confidence and peace of mind.

Home remodeling financing offers various options designed to suit different financial situations and project sizes. Whether you choose to pay in cash, use your home’s equity, or refinance, each method has its own benefits and potential downsides. In this article, we’ll explore the top three financing options available for home improvement projects:

- Cash Payment: An economical choice that eliminates interest payments.

- Home Equity Loans and Lines of Credit (HELOC): Ideal for accessing substantial funds at lower interest rates.

- Refinancing Options: Offers flexibility through specialized loan programs.

By examining these options in detail, including their pros and cons, you can make an informed decision that aligns with your budget and project goals. Whether you’re considering a small enhancement like a fresh paint job or a comprehensive remodel involving vinyl flooring, understanding your financing options is key to achieving the home of your dreams while maintaining financial peace of mind.

Furthermore, it’s crucial to think about how your chosen design will affect your overall budget. For example, deciding on a cedar pergola or a screen house can greatly enhance your outdoor area but also require careful financial planning. Additionally, using resources like those found in our design and planning category can offer valuable tips on making cost-effective design decisions.

1. Cash Payment

Opting for a cash payment when undertaking home improvements is often seen as the most economical option. It eliminates the burden of interest payments and circumvents the accumulation of debt, allowing homeowners to retain full ownership of their project without financial strain. Utilizing cash grants you control over budgeting and spending, which can be efficiently managed through a home improvement calculator.

Advantages of Using Cash for Home Improvements

- No Interest Payments or Debt Accumulation: Paying upfront with cash means there are no interest charges to worry about, translating to significant savings over time. This approach also prevents any additional debt from encumbering your financial situation.

- Full Ownership Without Financial Strain: By using cash, you maintain complete control over your home improvement project. This ensures that every decision aligns with your personal preferences and goals, without the pressure of impending repayments.

- Control Over Budgeting and Spending: A home improvement calculator serves as a valuable tool in managing expenses. It provides a clear overview of costs, helping you allocate funds efficiently and stay within budget limits.

Considerations Before Opting for Cash Payment

While paying in cash offers several benefits, it’s crucial to consider potential challenges:

- Maintaining an Emergency Fund Post-Renovation: It is essential to ensure that your emergency fund remains intact after completing renovations. Unforeseen expenses can arise at any moment, and having a financial cushion allows you to handle such situations with ease.

- Assessing Available Funds for Renovations and Unexpected Expenses: Before committing to a cash payment, verify that sufficient funds exist not only for the planned renovations but also for unexpected costs that may occur along the way.

Tips for Saving Up for Cash Payments

Creating a dedicated savings plan is pivotal when preparing to finance home improvements through cash payment. Consider these strategies:

- Set Clear Goals: Define specific objectives for your renovation project, including cost estimates. Having a clear target makes it easier to devise an effective savings plan.

- Create a Budget: Develop a comprehensive budget outlining all income and expenses. Identify areas where you can cut back on non-essential spending to boost savings.

- Open a Dedicated Savings Account: Establish an account exclusively for home improvement funds. This separation helps resist the temptation to dip into renovation savings for other purposes.

- Automate Savings Contributions: Set up automatic transfers from your primary account to your dedicated savings account. Consistent contributions will accumulate over time, bringing you closer to reaching your financial goal.

- Review Progress Regularly: Periodically assess your savings progress and adjust strategies as necessary. Staying informed about your financial standing ensures that any modifications are timely and effective.

Achieving success in financing home improvements through cash payments requires careful planning and disciplined saving habits. By understanding both the benefits and considerations associated with this method, homeowners can confidently navigate their renovation journey while maintaining fiscal responsibility.

If you’re considering some renovation ideas like finishing your basement or need some tips on storage solutions, remember that planning is key. Whether it’s flooring or other aspects of home improvement, each detail matters and should align with your budget and goals.

It’s also vital not to overlook the importance

2. Home Equity Loans and Lines of Credit (HELOC)

Home equity loans and lines of credit (HELOC) provide homeowners with practical financing solutions by leveraging the value they have built up in their homes. These options are particularly attractive for those planning substantial home renovations and seeking cost-effective borrowing.

How Home Equity Loans Work

- Lump Sum Disbursement: Unlike other borrowing methods, a home equity loan delivers funds as a single, lump sum. This is particularly beneficial for large-scale projects requiring significant upfront capital.

- Fixed Interest Rates: One of the key advantages is the stability offered through fixed interest rates. Homeowners can budget more effectively, knowing that their monthly payments will remain consistent throughout the life of the loan.

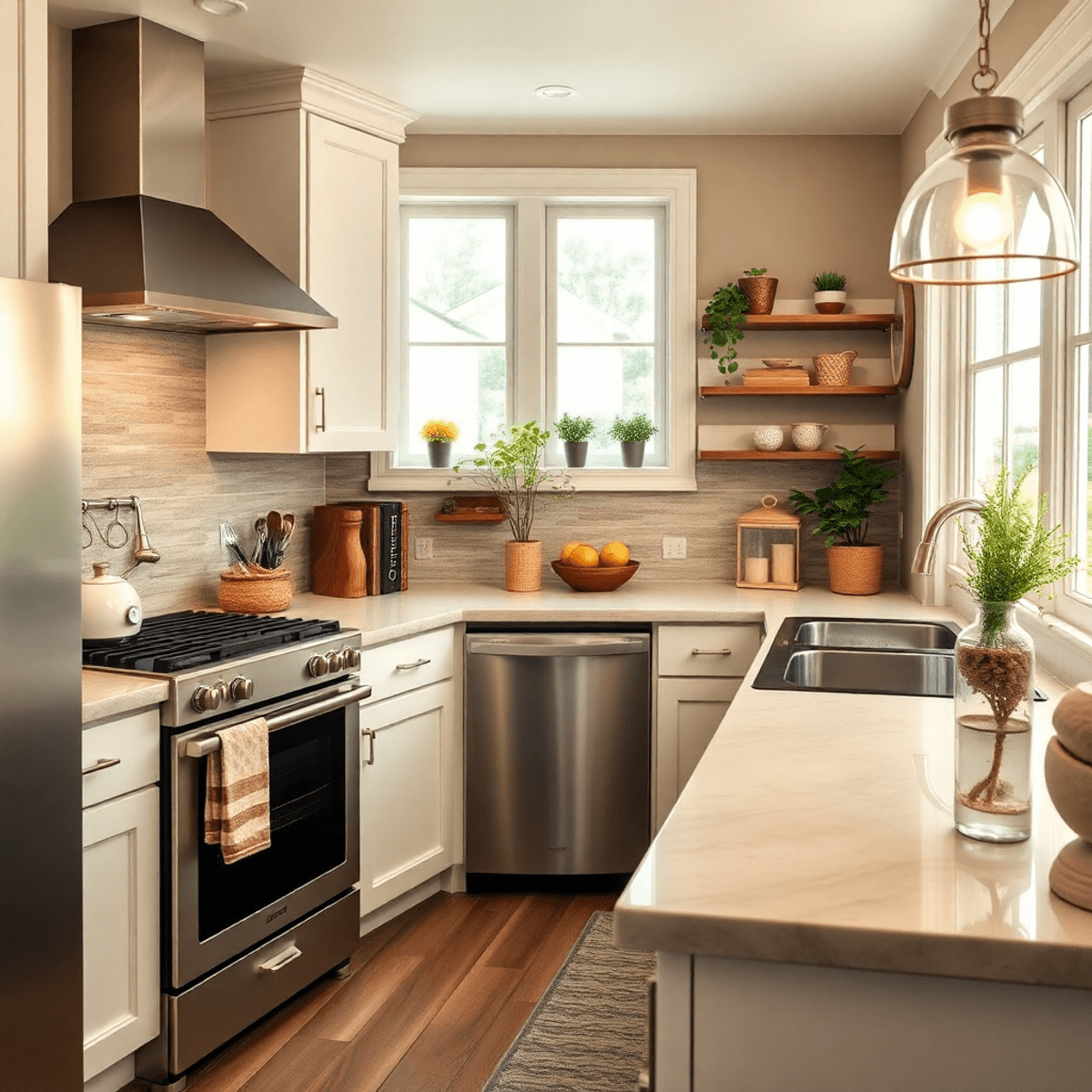

- Ideal for Large Renovations: Because of the lump sum nature and fixed rates, home equity loans are well-suited for major renovation undertakings — think kitchen remodels or home extensions — where costs are high and predictable.

Overview of HELOCs

- Revolving Credit Line: A HELOC functions similarly to a credit card, offering a revolving line of credit. This flexibility allows homeowners to draw funds as needed up to a pre-approved limit, making it ideal for ongoing or phased projects like landscaping or multi-room upgrades.

- Typically Lower Interest Rates: Compared to personal loans, HELOCs often come with more favorable interest rates. This can translate into significant savings over time, particularly when managing long-term projects.

Pros and Cons of Equity-Based Financing Options

Pros

- Lower Interest Rates: Both home equity loans and HELOCs usually feature lower interest rates than unsecured personal loans, effectively reducing the overall cost of borrowing.

- Potential Tax Benefits: Depending on your circumstances and local laws, interest paid on these loans may be tax-deductible. It’s advisable to consult with a tax professional to explore this potential benefit.

- Access to Large Sums of Money: These financing methods tap into the value of your property, often unlocking more funds than unsecured loans might offer.

Cons

- Risk of Foreclosure: Since these loans use your home as collateral, failing to meet repayment obligations could result in foreclosure.

- Potential Closing Costs and Fees: Borrowers should be aware of any associated fees which can add to the initial cost burden.

Best Practices When Considering Home Equity Loans or HELOC

- Consult With Local Contractors:

- Engaging professionals early can help accurately gauge project costs, ensuring you borrow an appropriate amount without overextending yourself financially.

- Conduct Thorough Research:

- Evaluate different lenders’ terms carefully. Look beyond introductory offers to understand true long-term costs.

- Evaluate Your Financial Stability:

- Assess whether your current financial situation supports taking on additional debt securely without jeopardizing your home ownership.

- Consider Future Financial Plans:

- If you anticipate changes in income or other financial commitments, consider how they might impact your ability to service new debt responsibly.

Choosing between a home equity loan and a HELOC depends on individual project needs and financial circumstances. Each offers unique benefits tailored to different renovation approaches—whether tackling one-time large expenses or managing multiple phases over time—ensuring you have access to funds when you need them most while maintaining control over

3. Refinancing Options

When it comes to financing options for home remodels, refinancing offers a strategic pathway to fund your renovation goals. This method allows homeowners to leverage their mortgage structure to access the capital needed for improvements. Two prominent refinancing strategies include cash-out refinancing and specialized loan programs like FHA 203k Loans and Fannie Mae HomeStyle Loans.

Cash-Out Refinancing

A popular choice among the top 3 ways to finance your home remodel, cash-out refinancing involves replacing your existing mortgage with a new one that has a higher balance. The difference between the old mortgage and the new one is taken as cash, which can then be used to finance your renovation projects.

How It Works:

- Increased Mortgage Amount: This option increases your mortgage amount, providing immediate funds for home improvements.

- Benefits:

- Access to significant cash resources without taking out an additional loan.

- Potentially lower interest rates compared to personal loans or credit cards.

- Opportunity to consolidate debt under a single, often more manageable payment schedule.

Specialized Loan Programs

For homeowners seeking additional flexibility, specialized loan programs like the FHA 203k Loans and Fannie Mae HomeStyle Loans provide unique advantages tailored to specific needs within the remodeling landscape.

FHA 203k Loans

These loans incorporate renovation costs directly into the mortgage process, simplifying the funding of extensive repairs or updates.

- Pros:

- Lower down payment requirements make it accessible for more homeowners.

- Ability to finance a wide range of repair and improvement costs.

- Cons:

- Lengthy approval process due to more complex underwriting standards.

- Additional paperwork may be required, adding layers of administrative effort.

Fannie Mae HomeStyle Loans

Known for their versatility in covering various types of renovations, these loans offer another powerful tool in your remodeling arsenal.

- Pros:

- Supports an extensive array of eligible projects, from minor updates to major overhauls.

- Competitive interest rates often rival those of traditional mortgages.

- Cons:

- May require higher credit scores or stricter qualifying criteria compared to other financing options.

Key Considerations

When evaluating refinancing as a means of funding your home remodel, certain considerations stand paramount:

- Long-Term Financial Implications: Understand how increasing your mortgage balance affects long-term financial health. Consider both immediate benefits and future obligations associated with larger monthly payments.

- Impact on Monthly Mortgage Payments: Weigh the impact on your monthly budget. While refinancing can offer lower rates, it might also extend the term of your loan, altering payment dynamics over time.

Aligning financing methods with personal financial circumstances ensures not only successful project completion but also long-term satisfaction with your investment choices. Recognizing these nuances will guide you toward selecting the most suitable option among these refinancing strategies.

Moreover, exploring alternative home renovation loans or construction loans can also provide viable funding solutions tailored specifically for remodeling projects. For those considering a more flexible approach, a HELOC could be an ideal option as well.

Making the Right Choice for Your Home Remodel Financing

Choosing the right home remodel financing option is a crucial step for any homeowner embarking on a renovation journey. Each financial pathway offers distinct benefits and potential drawbacks, making it essential to align your choice with your unique circumstances and project goals.

Key Considerations:

- Personal Financial Health: Evaluate your current financial situation, including income, savings, and existing debts. This will help determine which financing option is sustainable and aligns with your long-term financial plans.

- Project Scope and Budget: The size and cost of your remodeling project can greatly influence the best financing route. For instance, smaller projects might be more feasible with cash payments, while extensive renovations could benefit from refinancing or home equity loans.

- Risk Tolerance: Consider how much risk you are willing to assume. Options like home equity loans involve putting your home up as collateral, posing a higher risk if repayment becomes an issue.

Consultation with Experts:

Engaging with professionals can provide invaluable insights tailored to your specific needs. Rohrer for Construction, known for their kitchen remodels in Fox Lake and bathroom remodels in Lindenhurst, is dedicated to offering personalized solutions that cater to both budgetary constraints and design aspirations. Collaborating with local contractors ensures that you receive accurate cost assessments, allowing for better-informed decision-making.

“The most successful remodeling projects are those built on a foundation of strategic planning and informed choices.”

Top 3 Ways to Finance Your Home Remodel:

- Cash Payment: Offers complete control over spending without incurring interest or debt.

- Home Equity Loans/HELOCs: Ideal for those leveraging their home’s value for substantial projects.

- Refinancing Options: Suitable for integrating renovation costs into an existing mortgage structure.

Careful consideration of these options empowers homeowners to proceed with confidence, ensuring their remodel not only enhances the living space but also aligns financially. By collaborating closely with construction experts like Rohrer for Construction and local contractors, homeowners can achieve their vision while securing long-term satisfaction from their remodeled space. The goal is not just a successful renovation but a seamless process that prioritizes quality, innovation, and customer-centric solutions at every stage.

Whether you’re considering a bathroom remodel or contemplating whether to remodel or move, remember that each decision should be backed by thorough research and professional advice.

FAQs (Frequently Asked Questions)

What are the top three financing options for home remodels?

The top three financing options for home remodels include cash payment, home equity loans and lines of credit (HELOC), and refinancing options. Each method has its own set of advantages and disadvantages that should be considered based on your individual financial situation.

What are the benefits of paying cash for home improvements?

Paying cash for home improvements allows you to avoid interest payments or debt accumulation, ensures full ownership of the project without financial strain, and provides better control over budgeting and spending through tools like a home improvement calculator.

What should I consider before opting for a cash payment?

Before opting for cash payment, it’s important to maintain an emergency fund post-renovation and assess whether you have sufficient funds available for both renovations and any unexpected expenses that may arise.

How do home equity loans and HELOCs work?

Home equity loans provide a lump sum disbursement with fixed interest rates, making them ideal for larger renovation projects. HELOCs offer flexibility similar to a credit card with a revolving credit line, typically at lower interest rates compared to personal loans.

What are the pros and cons of using equity-based financing options?

Pros of using equity-based financing include lower interest rates, potential tax benefits, and access to large sums of money. Cons involve the risk of foreclosure if unable to repay, along with potential closing costs and fees.

What should I consider when choosing refinancing as an option?

When considering refinancing as an option, it’s crucial to evaluate the long-term financial implications, including how it will impact your monthly mortgage payments. Specialized loan programs like FHA 203k Loans and Fannie Mae HomeStyle Loans can also be beneficial but come with their own requirements and processes.