Introduction

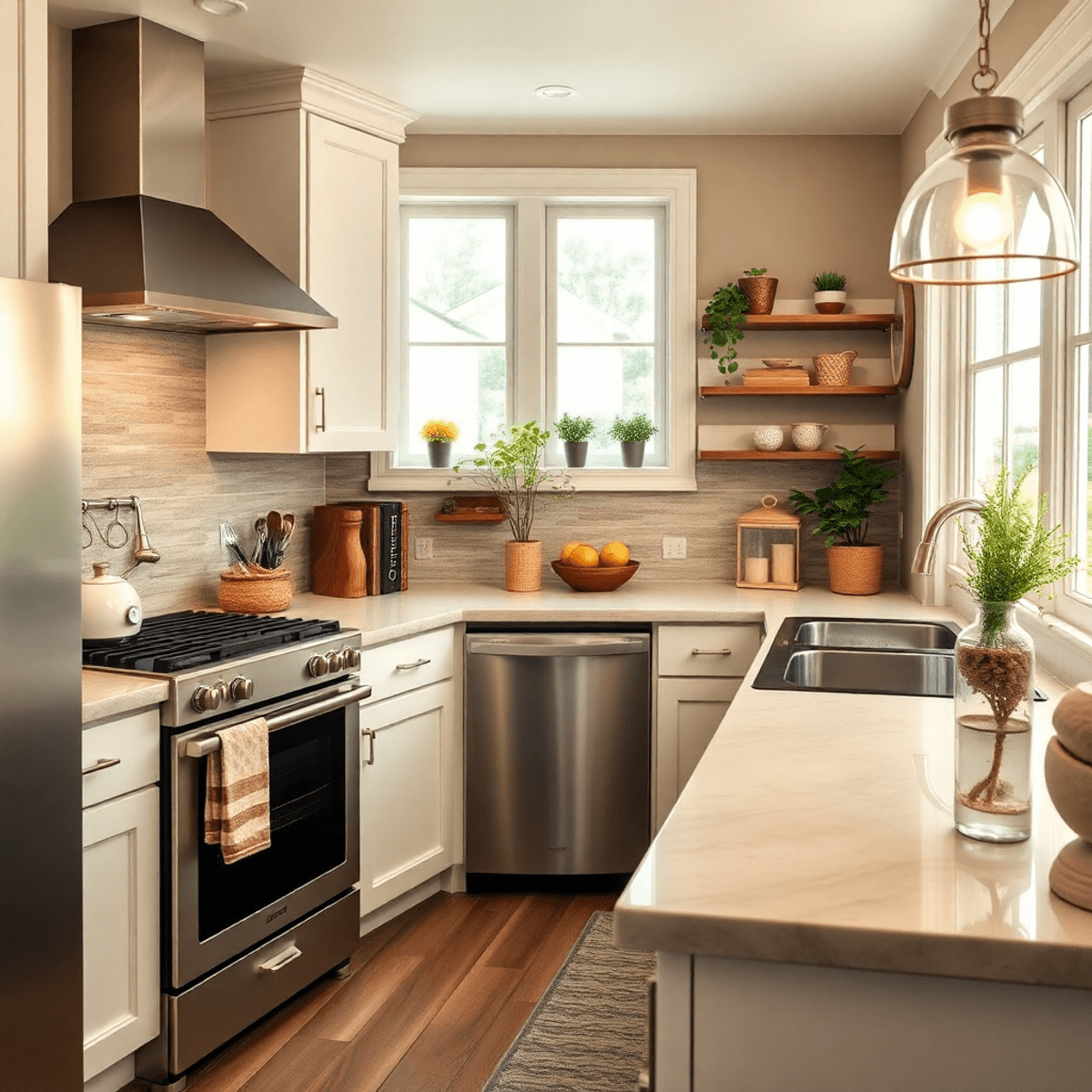

Remodeling your home can significantly boost property value while enhancing the comfort and functionality of your living spaces. Whether you’re planning a kitchen update, a bathroom makeover, or energy-efficient improvements, financing your remodel becomes a crucial step in the process.

For Lake County homeowners, home improvement loans present viable options to turn these dreams into reality. Several financing avenues are available:

- Home Equity Loans: These loans allow you to tap into the equity of your home, often offering lower interest rates.

- Personal Loans: A flexible option for those without sufficient home equity.

- Government Programs: Tailored solutions like FHA 203(k) loan programs provide comprehensive support by combining purchase and renovation costs into one mortgage.

Understanding the specific needs of Lake County homeowners is key when considering loan amounts and repayment terms. It’s essential to find an option that aligns with both your financial situation and remodeling goals. Each financing choice comes with its own set of benefits and limitations, making it important to evaluate them carefully to make informed decisions.

As you embark on this remodeling journey, consider practical updates that can enhance your home’s value and livability. For instance, installing ceiling fans can improve energy efficiency while adding aesthetic value. If you’re looking to revamp your kitchen, exploring Aldi’s best products could be beneficial for sourcing affordable yet high-quality items.

Moreover, certain plants like the African milk tree, known for their unique appearance and low maintenance needs, can serve as excellent indoor decor. Lastly, don’t forget about minor details such as maintaining cleanliness during the remodeling process; knowing how to remove lipstick stains from clothes could save you some trouble in case of accidental spills.

Understanding Home Improvement Loans

When considering financing options for home improvements, understanding the different types of loans available is crucial. Home improvement loans vary in terms, conditions, and eligibility criteria, with each type offering distinct advantages and drawbacks. For Lake County homeowners, selecting the right loan depends on factors such as the amount needed, current equity in your home, and your credit score.

Secured Loans

Secured home improvement loans utilize your home equity as collateral. This means you are borrowing against the value of your property, allowing you to access larger sums with typically lower interest rates compared to unsecured options. A popular form of secured loan is the home equity loan, often referred to as a second mortgage.

Benefits of Secured Loans:

- Larger Loan Amounts: Homeowners can borrow more significant amounts due to the collateral backing.

- Lower Interest Rates: Interest rates tend to be lower because the loan is less risky for lenders.

- Potential Tax Deductions: Interest paid on these loans may be tax-deductible, depending on how the funds are used.

Risks Associated with Secured Loans:

- Property at Risk: Failure to meet repayment obligations can result in foreclosure, as your home is used as collateral.

- Long-Term Commitment: These loans often come with longer repayment terms, which can extend financial commitment over several years.

- Market Fluctuations: Changes in the real estate market can affect the value of your home and, subsequently, your equity.

Understanding these elements helps you weigh the benefits against potential risks when considering a secured loan for your remodeling project. This type of financing can be particularly advantageous for substantial renovations or energy-efficient upgrades that require a significant upfront investment.

For instance, if you’re considering a major renovation like adding an Amazon Tiny House to your property or making aesthetic changes inspired by trends such as the Vampire aesthetic, Strega Nona aesthetic, or Cinnamon Girl aesthetic, a secured loan could provide the necessary funds.

For Lake County homeowners assessing their eligibility for secured loans, it’s essential to evaluate both current market conditions and personal financial stability. Consulting with local lenders can provide valuable insights into what specific terms might look like based on your unique circumstances.

By leveraging tools such as a Home Equity Line of Credit (HELOC) or exploring PACE Financing, homeowners have flexible and accessible routes to fund their renovation dreams while improving property values in Lake County. Each option carries its own set of conditions and should be chosen carefully to align with long-term financial goals.

Unsecured Loans

For homeowners who lack sufficient equity in their properties, unsecured loans offer a practical alternative. These loans, often referred to as unsecured personal loans, do not require collateral such as home equity, making them accessible for a broader range of applicants.

Several factors come into play when considering this type of home improvement loan. One crucial aspect is your credit score, which significantly affects both eligibility and interest rates. A higher credit score generally results in more favorable terms, potentially reducing the overall cost of borrowing.

Key Considerations for Unsecured Loans

- Loan Terms: Without the need for collateral, unsecured loans typically feature higher interest rates compared to secured options. However, they may also provide higher borrowing limits, accommodating various remodeling needs.

- Borrowing Costs: While these loans offer flexibility, the costs over time can add up due to the increased interest rates. It’s essential to weigh these costs against the immediate benefits of accessing funds for your remodel project.

Understanding these dynamics ensures you make informed decisions when selecting the most suitable types of loans for your specific circumstances. As you explore financing options, consider how different loan terms align with your budget and financial goals.

If you’re planning a home remodel that includes enhancing your property’s curb appeal or even preparing for seasonal changes like decorating for Halloween, these loans could provide the necessary funds. Additionally, if you’re considering adopting a Country French style for your home, an unsecured loan might just be the perfect solution to finance that dream renovation.

Local Financing Options in Lake County

Government Programs and Incentives for Lake County Homeowners

When it comes to remodeling your home in Lake County, exploring government-backed loans can be a smart move. Among the array of options, the FHA 203(k) loan program stands out as a versatile choice. This program is specifically designed for homeowners aiming to finance both the purchase price and renovation costs under one mortgage.

FHA 203(k) Loan Program Details

What it Offers: The FHA 203(k) loan merges the costs of purchasing a home with those of remodeling it. This means you can streamline your financing into a single loan, potentially simplifying your financial management.

Eligibility Requirements: To qualify, borrowers typically need:

- A minimum credit score (varies by lender but often around 620).

- Proof of income stability.

- A down payment as low as 3.5% of the total loan amount.

The key appeal lies in its ability to cover a wide range of home improvement projects. Eligible costs include:

Structural Repairs: If your home needs foundation work or major structural enhancements, this program can help manage those expenses.

Plumbing Upgrades: Outdated or inefficient plumbing systems can be revamped using funds from an FHA 203(k) loan. However, it’s important to note that some common household products, like certain dishwasher pods, could potentially cause plumbing issues if not used correctly.

Energy-Efficient Improvements: Projects like installing solar panels or enhancing insulation qualify, aligning with broader sustainability goals.

Lake County homeowners also have access to local lenders such as community banks and credit unions that offer personalized service and may provide competitive rates tailored to the unique needs of the community. These institutions often collaborate with government programs to deliver comprehensive financing solutions.

Exploring local resources, including credit unions and community banks, might unveil additional benefits such as lower fees or special programs for first-time borrowers. Engaging with these local lenders not only supports the community but can also lead to insights specific to Lake County’s real estate landscape.

For those who meet eligibility criteria, leveraging these government-backed loans offers a path towards achieving significant home upgrades without overwhelming financial strain. Understanding these options provides a solid foundation for making informed decisions about financing your remodel project in Lake County.

In addition to structural changes funded by these loans, homeowners might also consider aesthetic improvements such as investing in kid- and pet-friendly couches, which are stylish yet durable based on extensive testing. Or perhaps they might want to try their hand at baking with some easy dump cake recipes, which require minimal effort but yield delicious results.

State and Local Grants for Remodeling Projects in Lake County

Lake County homeowners looking to finance their remodeling projects can tap into various state and local grants. The California Residential Energy Efficiency Loan Program (CREELP) is a notable option, designed to fund energy-efficient upgrades that enhance home sustainability. This program emphasizes reducing energy consumption and environmental impact, offering financial support for improvements such as insulation, solar panel installations, and efficient HVAC systems.

Eligibility Criteria

Eligibility for grants like CREELP typically depends on factors such as:

- Income level

- Property location

- The specific nature of the proposed renovations

Homeowners must demonstrate how their projects align with the program’s goals, often requiring detailed proposals or assessments by certified professionals.

Role of Local Lending Institutions

Local lending institutions like community banks and credit unions play pivotal roles in facilitating access to these grants. They provide personalized service, often with quicker processing times and competitive rates compared to national banks. Their expertise in navigating government-backed loans ensures homeowners can effectively leverage available resources.

Benefits of Connecting with Local Lenders

Connecting with local lenders not only aids in understanding eligibility criteria but also streamlines the application process. By opting for these personalized services, Lake County residents can enhance their living spaces while contributing positively to their community’s environmental footprint.

For instance, those looking to add a touch of seasonal charm to their homes might consider using some of their remodeling budget towards purchasing affordable yet stylish decor. Stores like Aldi offer a range of products such as Halloween pillows that serve as cute dupes of Pottery Barn’s bestsellers. These pillows can help fill your home with festive spirit without putting a dent in your wallet, making them an excellent addition to any remodeling project.

Choosing the Right Loan Type For Your Remodel Project

Selecting the most suitable loan type for your remodel project involves evaluating various factors, prioritizing those that align with your financial goals and current situation. A thorough analysis can help you balance interest rates with repayment terms to ensure both affordability and convenience.

Key Considerations:

- Interest Rates: Look for competitive interest rates that minimize the overall cost of borrowing. Secured loans might offer lower rates due to collateral, while unsecured options could have higher rates but no risk to your property.

- Repayment Terms: Opt for a term length that fits comfortably within your monthly budget. Shorter terms generally mean higher monthly payments but less interest over time, whereas longer terms reduce monthly expenses but increase total interest paid.

- Loan Amounts: Determine how much funding you actually need. Over-borrowing can lead to unnecessary debt, while under-borrowing might leave your project incomplete.

Creating a realistic budget is crucial for managing costs effectively throughout your remodel. This involves accurate cost estimation and proactive financial planning:

Budgeting Tips:

- Assess Your Needs: Identify essential improvements versus optional upgrades. Prioritizing necessary repairs ensures critical issues are addressed first.

- Detailed Cost Estimation: Break down project costs into materials, labor, permits, and contingencies. Obtain multiple quotes from contractors to gauge market rates accurately.

- Contingency Planning: Set aside at least 10-15% of your total budget as a cushion for unexpected expenses or price fluctuations.

- Use Financial Assessment Tools: Leverage online calculators or consult with financial advisors to get a clear picture of potential costs and financial commitments.

By carefully weighing these factors and employing effective budgeting strategies, you can choose the right loan type that facilitates a seamless remodeling experience, aligning with both your vision and financial capacity.

For instance, if you’re planning to remodel your living room, understanding the difference between a sofa vs. couch could help in making informed decisions about furniture purchases within your budget. Similarly, if your remodeling project includes tiling work, knowing whether to use sanded vs. unsanded grout can significantly impact the outcome of your project.

In case you’re considering adding some greenery like peonies in your remodeled garden space, it’s vital to know when to plant peonies for optimal growth and blooming results. Also, if you’re looking for creative ways to decorate your home during Halloween post-remodeling, drawing inspiration from horror films could add a unique touch to your decor.

Conclusion: Making Informed Decisions About Financing Your Remodel

When considering financing your remodel decisions, assessing your personal financial situation is crucial. Evaluate monthly affordability and long-term implications, such as refinancing potential and property value appreciation.

- Evaluate Affordability: Determine how much you can comfortably repay each month without straining your finances.

- Consider Long-Term Impacts: Think about how the loan might affect future refinancing opportunities or increase your home’s resale value.

By leveraging resources like local lenders’ expertise and government-backed support schemes, you can make informed choices that align with your goals. Each financing option offers unique advantages, whether it’s a Home Equity Line of Credit (HELOC) for flexible funding or the USDA Section 504 Home Repair program for low-income homeowners.

Your dream home transformation is within reach when you take advantage of the diverse loan options available to Lake County homeowners. For instance, if you’re looking to enhance your living space effectively and sustainably, consider investing in a tiny home from Home Depot, which offers sleek designs at affordable prices.

Moreover, don’t forget about practical improvements like upgrading your garage door opener. You can explore the best garage door openers available in the market, which can significantly enhance your home’s functionality and value.

FAQs (Frequently Asked Questions)

What are the main financing options available for home remodeling in Lake County?

Lake County homeowners have several financing options for remodeling, including home equity loans, personal loans, and government-backed programs like the FHA 203(k) loan. Each option varies in terms of loan amounts, interest rates, and eligibility requirements.

How do secured home equity loans work for remodeling projects?

Secured home equity loans allow homeowners to borrow larger amounts by using their home equity as collateral. This typically results in lower interest rates. However, there is a risk of losing your property if you fail to make timely repayments.

What are unsecured loans and how do they differ from secured loans?

Unsecured loans do not require collateral and are based on the borrower’s creditworthiness. While they often come with higher borrowing limits, they also carry higher interest rates compared to secured loans. Homeowners without sufficient equity may consider this option.

Can I use government programs to finance my home remodel in Lake County?

Yes, Lake County homeowners can utilize government programs such as the FHA 203(k) loan program, which allows borrowers to finance both the purchase price and renovation costs into one mortgage. Eligibility criteria include specific property types and renovation costs that can be covered.

What local lending institutions are available for home improvement loans in Lake County?

Local lenders such as community banks and credit unions in Lake County specialize in providing personalized service for home improvement loans. They often offer quicker processing times and competitive rates compared to larger national banks.

How can I choose the right loan type for my remodeling project?

Choosing the right loan type involves evaluating your financial situation, considering interest rates alongside repayment terms that fit your budget. It’s also essential to create a realistic budget for your remodel project to avoid overspending during construction.

Leave A Comment